Financial Regulation: From the Global Financial Crisis to Fintech and the COVID Pandemic

Add to Favourites

Price:

5511 EUR

Contact

Massachusetts Institute of Technology

Description

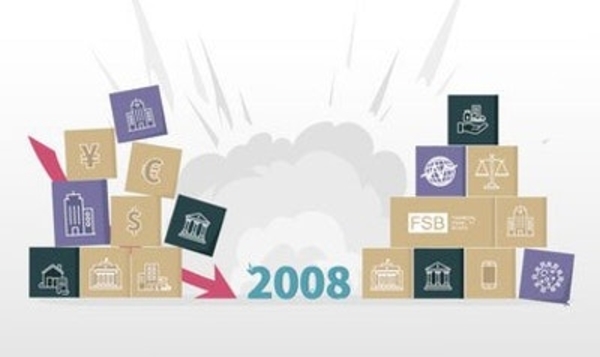

This course will provide the underpinning rationale for financial regulation and evaluate the post-Global Financial Crisis reforms in this light, noting adaptions that were required due to systemic nature of the crisis and the need to ensure private sector compliance. It then applies these rationales and lessons learned to current topics in Fintech and the response to the Covid-19 pandemic.

The objectives of this course are to:

Identify the goals of financial regulation and understand the conditions under which regulation would make the financial system safer and more efficient and when it could be counterproductive.

Identify the precursors and vulnerabilities that give rise to financial crisis, including historical contexts, technological developments, and private sector responses to previous regulation.

Understand the main tools currently in use to mitigate stand-alone risks in individual financial institutions as well as stability risks to the financial system as a whole and evaluate their effectiveness, noting unintended consequences.

Apply the basic rationales and goals for regulation to technological financial innovations (e.g., fintech) and how the post-2008 reforms have influenced the ongoing responses to the financial implications of the COVID pandemic.

----

“Understanding how financial regulation evolved following the Global Financial Crisis of 2008, and how it shaped the financial industry, is vital for regulators and for the financial practitioners they regulate. This course provides the underpinnings for a critical assessment, challenging us to think through how regulation needs to adapt to today’s challenges.”

-- Dr. Ben Bernanke, former chair of the Federal Reserve

Specific details

Category of Education

Business and Economics